BREXIT – IT’S POTENTIAL IMPACT ON SYSTEMS AND COMPANIES IN THE METAL DISTRIBUTION CHAIN

What Does It Mean To Me?

With the confusion and inaction that has surrounded the decision by the British people to leave the European Union, it would be unreasonable to say that as a company Jonas Metals and its subsidiary in the UK Metalogic has covered all the bases and potential requirements. Rather than attempt that this document reviews some of the known issues, that will apply if we leave with no deal – it covers what we as a company have done to our systems to provide solutions to potential issues. We have also provided links to sources of information that you may wish to access to ensure you are as prepared as you can be for this unique event.

Life outside the single market & customs union

The following list is not exclusive but it covers the main changes that will take place following our exit subject to any negotiated agreements.

• Goods will not circulate freely

• A border will exist between the UK and the EU

• Customs documentation will be required

• Goods will be checked

• UK manufacturers will need to prove the UK origin of their goods

• The UK will set its own tariffs

• The UK to negotiate its own trade arrangement

Why are these facts important? Well, the impact of Brexit on the UK metals sector could be significant due to a number of factors.

The dependency of the UK on imports and the application of Tariffs.

Looking at two of the main distributed products Steel and Aluminum we can see the dependency the UK has on imports and how this may grow.

STEEL

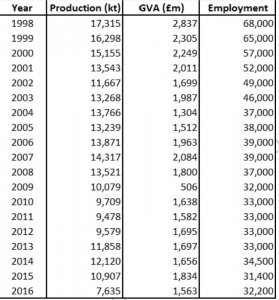

With the reduction in the capacity of “home” production, the uncertainty of the ownership and future of “British Steel” and other UK plants, imports of steel are likely to continue to grow as the capacity of the UK steel sector has reduced over the last two decades. Between 1998 and 2016, production has fallen by 56 percent, GVA has fallen by 45 percent (in nominal terms) and employment has fallen by about 53 percent as can be seen from the table.

Trends in Production.

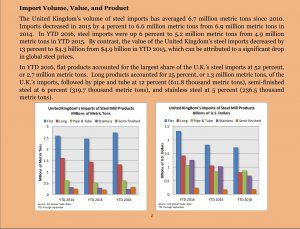

The latest reliable figures for imports confirm this and show the UK’s reliance on overseas suppliers.

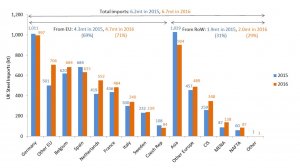

If we look at these numbers broken down by source we can see the reliance on European Trading partners.

ALUMINIUM

Primary aluminium output has fallen substantially in recent years. There is only one remaining primary smelter in the UK. All other operators in the UK aluminium production industry are secondary producers that re-melt scrap aluminium. The UK aluminium production industry is heavily exposed to both shifts in demand from downstream markets and changes in the global price of the commodity. This exposes the industry to international developments, namely global economic conditions which play a key role in determining the demand for aluminium and its price. International economic difficulties have made recent years difficult for aluminium producers. However, world aluminium consumption is expected to grow strongly over the next five years, supported by demand from a number of emerging countries. Environmental regulation could continue to place cost pressures on the industry.

| Year | Number of enterprises | Total turnover (£m) | Approximate gross value added at basic prices (aGVA, £m) |

| 2008 | 183 | 2,427 | 474 |

| 2009 | 166 | 1,424 | 129 |

| 2010 | 161 | 1,745 | 375 |

| 2011 | 144 | 1,589 | 300 |

| 2012 | 138 | 1,263 | 129 |

| 2013 | 131 | 1,370 | 218 |

| 2014 | 129 | 1,284 | 286 |

| 2015 | 127 | 1,295 | 266 |

| 2016 | 127 | 1,413 | 275 |

With these pressures and the reduction in capacity, relationships with importers and overseas suppliers will become increasingly critical for distributors in this sector.

TARIFFS

We have already seen a round of tariffs applied by countries imposed as countervailing duties to offset the effects of subsidies made to producers of the goods in the exporting country, (USA China for example).

With our exit from the EU and in the absence of a preferential trade agreement, goods imported into the EU from non-EU countries must pay a tariff. Tariffs are custom duties levied on imported goods. Under WTO Most Favoured Nation (MFN), a country’s tariff schedule must be consistent for all countries it trades with, except those where a preferential trade agreement exists. EU MFN tariff rates vary depending on the goods. Currently, the EU imposes 0 percent Most Favoured Nation (MFN) tariffs on all semi-finished and finished steel products. However, the picture is more varied across the end goods which steel products are processed into, and some of these have non-zero MFN tariffs. The EU’s simple average of MFN applied duties is 2 percent across all metals and minerals, and 4.3 percent for transport equipment.

Tariffs can also be used for trade defence purposes. This includes temporarily increasing tariff rates to restrict imports of specific goods deemed to be injuring domestic production due to ‘dumping’ by a third country at below normal prices. For example, in 2016 the EU determined that steel from China was being exported to the EU below market price. The EU applied a 74 percent tariff to this Chinese steel to ensure EU producers were able to remain competitive.

Some Facts Relating To Tariffs

You will need to pay trade tariffs on some goods if you’re moving them to or from the EU.

All imports or exports (including UK imports) must be declared to HMRC using an international commodity (tariff)code.

You’re legally responsible for the correct tariff classification of your goods.

Once your goods have the correct tariff code you can work out the correct duty you need to pay on the import or export of your good.

Information Technology Systems.

The potential increase in the number and types of Tariffs that may be applied mean that Information Systems have to be able to handle subsidies and discounts in a whole new way.

Never before in the UK have we seen a potential requirement of this level and it has required a significant amount of work on behalf of the development team to add flexibility into the iMetal system to handle the potential requirements that may arise.

To ensure we covered all the bases in our last newsletter we surveyed 300 clients to assess how many were using tariffs and commodity codes. The response we got was not particularly great but we believe that this is more down to the lack of clarity in regards to the potential issues rather than clients not using or needing to use tariffs or commodity codes in the future (hence this article).

The problem is no one really knows what will be required as we are heading into unknown territory. However, the software takes time to be specified, developed and tested therefore we cannot wait for negotiations to be completed or Governments to decide if a Tariff needs to be applied or not.

So with this in mind, we appointed a number of our team to attend Brexit briefings at steel associations, board of trade and other sources of information to gather as much data as possible that could then be applied to ensure your software is as ready as it can be to handle the changes that we will see over the coming months.

Actions You Should Take

Importing & Exporting

Most of you will be aware of the steps you should have taken or be taken to allow your business to continue to trade after Brexit. We have outlined a list of activities on our dedicated Import/Export page and broken this up into a number of areas, Import-Export, business issues to consider and data protection. We have not attempted to provide all the answers but to raise questions (and some guides and information) that hopefully, you will already have considered.

Brexit Business Issues to Consider

Whilst not exclusive some of the items on this list may apply to your business and in some cases require us to help with configuration of your iMetal system and its data. Please contact your account manager for further information.

- Contracts and Commercial disputes

- Intellectual property rights

- Ireland and the Common Travel Area

- Company formation and company officers

- UK nationals living in the EU

- GDPR.

Data Protection and a No Deal Brexit.

GDPR will continue to apply in domestic law. This will mean that the requirements you put in place in relation to websites, cookies, storage of data and disposal will still apply and in some cases become intensified. Under a No-Deal, it’s unlikely that the EU will treat the UK the same as before.

There will be no changes to domestic standards or the rights of UK data subjects

Action will be needed to avoid disruption to international data flows. If you have EDI or other electronic interfaces in place consider the implications. Storage of clients’ personal details and financial information may need to be reviewed

This may particularly apply if you have employees working for you in European countries or European citizens working here. Consider Personal data includes names, physical and IP addresses, HR data and payroll details.

You may not know them all so check where data is being stored on your behalf?

ICO Guidance

Finally

We are all operating in the dark at the moment in relation to what Brexit will actually mean.

The Team at Metalogic have worked hard to ensure that we have as many of the known issues covered (and some of the unknown ones as the best guess) but if you have any concerns or need to discuss issues that you feel are unique to your business please do not hesitate to contact your customer service team or account manager.

IMPORTING & EXPORTING POST BREXIT

Post Brexit Importing & Exporting – Actions You Should Take Most of you will be aware of the steps you should have taken or be taken to allow your business to…