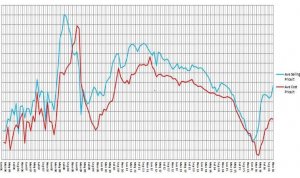

The Steel Market remains a challenge, the Grid up to Nov 16 shows average cost price/t against selling – that’s 4 months old now at latest point but highlights volatility. However, what the below does show is that the gap between cost and selling price is as big as its been for 10 years.

Within the Steel market, there continues to be fierce competition, over capacity, exchange rates, high energy costs and increased uncertainty due to Brexit continues to impact upon the financial strength of many businesses. The market continues to be difficult, but Underwriters are supporting to try and support trade. The standard terms tend to be 60-75 days, although we are fully aware due dates are seemingly fictional and we understand the nature of the sector and support with a healthy extension period.

Within the Steel market, there continues to be fierce competition, over capacity, exchange rates, high energy costs and increased uncertainty due to Brexit continues to impact upon the financial strength of many businesses. The market continues to be difficult, but Underwriters are supporting to try and support trade. The standard terms tend to be 60-75 days, although we are fully aware due dates are seemingly fictional and we understand the nature of the sector and support with a healthy extension period.

British steel producers have suffered from the increased levels of steel shipments originating from Russia and China, while steel prices remain depressed, largely as a result of low commodity prices and in particular iron ore. As always the intrinsically linked construction sector has a direct effect on steel, being its main consumer and insolvencies for the past year, although have shown a slight reduction, it is very slight with just over 2,500 companies entering a form of administration.

The Underwriting market have met with Tata / British Steel and they continue to provide Underwriters with up to date information. This has allowed for cover to be underwritten by some Underwriters, not all. In addition you will also note that Arcelor are back in the black in a rather big way in their last financial announcement. This has also allowed for larger limits to be written. Another risk where Management Information has been supplied is Liberty Steel and we now have appetite for this risk. However, one thing to note on all these risk they would be under a Special Risk Monitor and the amount being Underwritten would certainly be case dependant.

In short, the underwriting market is open for business, albeit watchful of their capacity but we are supporting clients and welcome meetings to discuss Credit Insurance but also to support the Supply Chain by working with a ‘risk’ with the underwriters to support their credit availability.

To discuss any of the issues further please do contact Graham Green details below.

Credit & Business Finance Ltd

Friars Mill | Bath Lane | Leicester | LE3 5BE

07944 092166 | [email protected] | www.cbfb.co.uk

Summary of the Steel Sector following NEASS AGM 2017

Following the recent NEASS AGM Colin Sanders gives us this summary of the current state of the sector. It is widely recognised that 2016 was a year of two halves…