Neass Annual Dinner 2018 Helping To Make Wishes A Reality

Metalogic customers and staff attending the recent NEASS Annual Dinner in Harrogate were delighted to be a part of a fantastic fundraising effort to support two very worthy charities.

Winston’s Wish were the UK’s first childhood bereavement charity – supporting bereaved children since 1992. Established by Julie Stokes OBE, a clinical psychologist, in 1992 to meet the needs of bereaved children and their families. The idea took root when Julie visited the US and Canada on a Winston Churchill Travelling Fellowship. Having been inspired by the services she saw there, Stokes returned to the UK and set up Winston’s Wish.

Purple Heart Wishes was established to help adults between the age of 18 and 40 with terminal illness, to experience a dream of a lifetime by granting wishes and building memories. Founded in memory of Lyndsey Roughton, who was diagnosed with a brain tumour in November 2009 and sadly passed away in February 2014, the charity name derived from the ‘Purple Heart Medal’ given to brave American soldiers who have been wounded or killed whilst serving their country. It was Lindsey’s steely determination and bravery that the family decided that the name of ‘Purple Heart’ was befitting of a brave person, their soldier.

Gathering once again at The Old White Swan in Harrogate the 209 members and guests enjoyed an entertaining evening of networking and fundraising with the indisputable Paul Riordan MC overseeing the proceedings and Yorkshire comedian Mike Farrell as guest speaker providing the mirth and merriment.

Thanks to the generosity of NEASS members and their guests just under £2,300 was raised for these two wonderful charities. Read more about the difference that this will make to Winstons Wish and Purple Hearts.

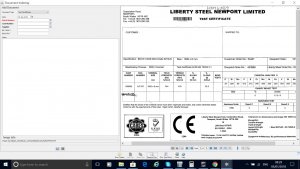

iMetalScan+ Provides Multiple Format Storage

Fifteen years ago Metalogic developed a stand alone scanning system to handle test certification called Imago X. iMetalScan followed which was integrated into the iMetal ERP system. Now available in version 2.38 is iMetalScan+.

Reasons for its development? Changes in browser and mobile technologies dictated that Metalogic refreshed the supporting technology. Beyond this, our client’s requirements for accepting multiple formats, storing and accessing them in many ways, lead to a complete rewrite of the application.

iMetalScan + is now available as an integrated iMetal module, and also as a stand-alone system that can be used by itself or integrated with other ERP type applications.

It has been built on the success of its predecessor and provides the same easy to use functionality and data structures, as well as the following enhancements:

- Ability to store images as tiff, png, jpg, bmp, pdf or gif

- Ability to link images to IMetal data (e.g. Stock Items, Customers, Suppliers, Sales Items, etc)

- Ability to view Test Certificates, POD, Other scanned documents directly from within iMetal

- Ability to select files from local directories as well as server file systems

- Additional image management options such as annotations.

To ensure smooth and successful migrations, import functionality has been developed alongside the new iMetalScan+, which will allow documents and indexes to be imported from earlier iMetalScan versions or third party scanning solutions.

Existing clients can access the release notes for Version 2.38 with details of the new application and should contact their account manager for details of how to upgrade.

New clients interested in cost effective document management solutions should contact [email protected]

Award Winning Software Recognised

Metalogic were delighted to scoop the Research and Development Innovation Award at the recent Jonas Software Awards in Birmingham last month as their ground breaking work on the Internationalisation of iMetal was recognised.

The award for innovative development was presented by Scott Saklad Jonas Software’s Portfolio Manager and acknowledged Metalogic’s development team for the work they had achieved in ensuring that iMetal software was compatible to users all over the globe.

As iMetal is now implemented in 15 different countries through Jonas Metals Division the differing metal terminology and spellings had to be addressed to ensure this was a marketable product and as the video demonstrates this was realised through internationalisation development. See how this was achieved in the video below.

https://www.youtube.com/watch?v=rE6WSX4jVw4

Image: © Paige Archer

GDPR – What is it? Are you aware of it? Have you planned for it?

GDPR – What is it? Are you aware of it? Have you planned for it?

One of the roles that Metalogic carry out on behalf of their customer base is to be aware of forthcoming legislation that will impact on them both from a system and business viewpoint. Over the last ten years this has seen Metalogic staff sitting on committees to review and standardise EDI in the European Steel Industry, attending ISO 9000 briefings and more recently working with the BSSA in assuring that iMetal meets all the requirements of CE marking. Now with no time to take a breath a piece of legislation due to come into force early next year is occupying our attention.

Despite wide coverage and with only having a little more than six months until the EU General Data Protection Regulation (GDPR) compliance deadline, a recent survey has shown that 55% of UK small businesses are still unaware of GDPR.

Lack of knowledge of the legislation is surprising, with 27% of all senior decision-makers at UK organisations questioned unfamiliar with the changes introduced by GDPR.

The survey also revealed that 20% of senior decision-makers said their organisation have yet to put a plan in place to prepare for GDPR, with an additional 19% saying they don’t know if their organisation is prepared for GDPR.

Key changes introduced by the GDPR

The GDPR will supersede the current Data Protection Act (DPA) and will extend individuals’ data rights.

The Regulation will be enforced from 25 May 2018 and introduces a number of key changes to data protection laws:

- It broadens the definition of ‘personal data’ to encompass an individual’s mental, economic, cultural and social identity.

- It requires parental (or equivalent) consent to process children’s data.

- It changes the rules for obtaining valid consent when collecting data. Consent must be given by a clear and affirmative action.

- It mandates the appointment of a data protection officer (DPO) for certain companies.

- It requires data protection impact assessments (DPIAs) for organisations that undertake high-risk data processing activities.

- It requires data controllers to report a data breach within 72 hours of discovery.

- It gives data subjects the right to be forgotten.

With organisations facing significant fines for non-compliance (up to 4% of annual global turnover or €20 million – whichever is greater), it is essential that all staff, including senior decision-makers, understand the requirements of the new regulation and how it will affect them.

Does it affect me and my organisation?

It affects everyone and whilst most companies in the metals sector have business to business transactions they may and will have data regulation responsibilities under the tighter guidelines of GDPR.

Why do we need these revised regulations?

Due to the growth of the internet and changes in behavioural advertising and social media, personal data is now being used in ways that were not envisaged at the time the current EU Directive was drafted making it not fit for purpose. There is a public led, political impetus for stronger data protection resulting in the need for GDPR.

What is Metalogic doing to keep pace with GDPR changes?

As with all legislation, environmental and technical changes that impact on its customers, Metalogic has already made a commitment to our customers that we will help them meet the requirements of this legislation ahead of May 2018.

As part of this work, within the newly formed “Jonas Metals Division” we are working with a specialist consultancy to review the impact that GDPR will have on our customer base. From this we will be making the changes that our ERP applications will need to be enabled to handle.

We are working towards our products being built according to the ‘Privacy by Design’ principle enabling our customers to fulfil their duties in adhering to EU GDPR. These proposed changes will be reviewed with a specialist GDPR lawyer, to ensure correct and complete interpretation of the law.

At this stage our expectation is that there will be modules and products that will need to be changed to align with the GDPR legislation – facilitating our customers’ ability to be compliant with the GDPR. As our review progresses, we will advise the schedule for software updates, also whether there are any areas that do not require updates.

We started work on this in early 2017 and new versions of products should be ready to be deployed to our customers from March 2018. Please note that all product modifications will be made to the general release version of the software only.

We advise customers on legacy versions of our products to therefore start discussing upgrades in conjunction with your Metalogic Account Manager.

Some of the older legacy versions may require an interim upgrade – for compatibility with GDPR until the client is ready to upgrade to the latest GDPR ready version.

Metalogic will be working closely with our hosted customers to ensure GDPR regulatory guidance.

All Metalogic customers will have the option to upgrade to GDPR ready versions by May 2018 to fulfil their duties in adhering to EU GDPR.

What Should our customers be doing ?

Customers should review all existing processes in place within their organisations that relate to the storage and use of client’s / contacts personal data. In particular, consider areas relating to:

- Consent – it should be possible to trace and identify what an individual has consented to, as well as the time and method of consent. This consent could cover contact details joining information, health data, and marketing preferences. It should also be possible for a member to change preferences or withdraw consent easily.

- Security of data – Metalogic customers not using password rotation should consider moving to this functionality.

- Capture of children’s’ data – the GDPR states that parental/guardian consent for access to online services is required for children – in the UK <13 years old. This means that as an operator, you need to consider if your store any data on or about children. Do you note details of a client’s family members in your CRM/marketing databases.

- Archiving and deletion of end customer data – it is worth re-examining both the length of time you need to retain data on contacts and the way that you store this.

- Analytics, anonymization, and profiling – cookies should be treated as personal data and require consent – cookies set for different purposes may need separate consent. For your own websites, consider whether you have cookie consent exemption, automatic anonymization of visitor id, respect for DoNotTrack preferences, and opt-in/out on any privacy policy pages.

Reviewing your own processes is time consuming and complex, for this reason, Metalogic encourages its customers to seek qualified GDPR legal advice to ensure compliance with the GDPR.

It should be emphasised that Metalogic software alone cannot make an operator compliant as the regulation applies to all processes and practices performed by operators. However, we aim to ensure that by upgrading to our latest GDPR versions; discussing your needs and processes with a Metalogic consultant will enable customers to build compliant practices within their organisations more easily to fulfil the main areas covered by the legislation.

Metalogic Merger To Increase iMetal’s Global Reach

iMetal’s recent success in the marketplace now confirms Metalogics leading position for the supply of software to the metals processing & distribution centres. This growing success follows the procurement of ten new clients for Metalogic so far this year along with growth in the global market with implementations in North America, Europe and the Far East.

Following this increasing activity it has been recognised that an expansion of service and support was required. To achieve this Metalogic has acquired Compusource MCMS in North America.

MCMS – who will be trading as JMUSA (Jonas Metals USA) will be supporting Metalogic with sales, implementation and support of iMetal in the North American market and the acquisition means that collectively Metalogic & JMUSA will hold a global base of 550 sites with over 6,000 licensed users worldwide.

To support this some structural changes will take place within the company and Leigh Harrison will now head up the newly formed Jonas Metals Division – the new umbrella organisation for the provision of software systems within the metals market.

Leigh Harrison ‘While for the most part it will be business as usual for our clients, we are delighted with this next chapter in the Metalogic story and look forward to working closely with MCMS under Jonas Metals Division to increase iMetal’s reach and further serve metals companies of all sizes, products and processes, in North America and around the globe.”

John Padbury will be moving to General Manager of Metalogic and alongside Brian David who is Vice President of MCMS with both companies working to grow the Jonas Metal Division worldwide.

Foreign supply remains a critical issue for the EU steel sector

Strengthening investment and robust exports are boosting the performance of steel-using sectors in the EU. Steel demand is expected to continue its gradual recovery in 2018. However, increasing import pressure in in the second quarter of 2017 signals that foreign supply remains a critical issue for the EU steel sector.

EU steel market

Apparent steel consumption in the EU fell slightly in the second quarter of 2017, following robust growth in the first quarter. This slight year-on-year dip was a technical correction related to the stock cycle rather than a sign of weakening in the underlying consumption trend. Unfortunately, EU domestic suppliers bore the brunt of this demand dip; their deliveries into the community market fell by 3.5% year-on-year in the second quarter, whereas third country imports grew by just over 10% year-on-year.

“The relative balance between growth in domestic and foreign supply seen in the first quarter of 2017 was reversed at the expense of EU steel mills. Despite a reduction in imports from China and several other countries owing to corrective anti-dumping duties put in place third country import volumes have risen again in the second quarter, said Axel Eggert, Director General of the European Steel Association (EUROFER).

First estimates for apparent steel consumption in the third quarter of 2017 signal a return of EU steel buyers to the market. The destocking in the second quarter is expected to have led to a lower-than-usual inventory reduction in the third quarter. The forecast for fourth quarter apparent steel consumption is for continued year-on-year growth, but with seasonal destocking dampening growth over this three month period.

Overall, EU apparent steel consumption is forecast to increase by 2.3% over the whole year 2017. Steel demand is expected to continue its gradual recovery in 2018, driven by the expected rise in real steel consumption in the EU market and very modest support from the stock cycle. This continues the gradual recovery in steel demand that began in 2014.

As has been the case in recent years, the extent to which EU steel suppliers will actually benefit from growing EU demand is uncertain. Import distortions remain the main risk for the stability of the EU steel market.

EU steel-using sectors

Business conditions in EU steel-using sectors remained supportive to growth in the second quarter of 2017. Production activity grew by 3.1% year-on-year, and first quarter 2017 growth was revised up to 6.3% compared to the same period in 2016. The positive trend in output over the first half of 2017 was the result of an increasingly synchronised and robust performance across EU member states and of steel-using sectors therein.

Mr Eggert said, “We welcome the healthy performance of relatively steel-intensive sectors. These include the automotive and engineering industries, as well as tube manufacturers, over the first half of 2017. Growth in the construction industry was the strongest it has been for many years and clearly reflects improving fundamentals in this important steel-using segment”.

Estimates and forecasts for the second half of 2017 are for a continuation of the robust growth trend seen in the first half. On balance, total output in 2017 is forecast to rise by 4.2%.

The outlook for 2018 is positive overall. The relatively strong anticipated growth in investment, and the continued expansion of private consumption, will support EU domestic demand. Exports will also contribute to further activity growth among steel-users. Output in the EU’s steel-using sectors is forecast to grow by 1.9% in 2018.

EU economic context

The economic upswing in the EU is becoming increasingly synchronised across countries and GDP spending categories. Multi-year peaks in confidence indicators at the end of the third quarter of 2017, robust hard data on the labour market, in services and in manufacturing, bode well for the performance of the EU economy in the final quarter of 2017 and in 2018.

The business climate looks set to remain supportive to continued healthy investment growth, whereas private consumption growth is foreseen to slow down somewhat. In combination with stable growth of government consumption, domestic demand will be the major driver of economic growth in the EU. Meanwhile, prospects for the external sector remain positive as well, owing to a favourable outlook for the global economy and international trade activity in 2018.

On balance, EUROFER’s October 2017 outlook forecasts EU GDP growth of 2.1% in 2017 and of 1.9% in 2018.

This report was first published by Eurofer on 25th October 2017. For the full report, please click here: Economic & Steel Market Outlook 2017-2018

Sporting Celebrities at the ASA Matt Le Tissier Golf Day

Metalogic’s Nigel Johnson and Geoff Kendell attended the annual ASA Matt Le Tissier Golf Day last month and not only had the pleasure of a sporting celebrity, but a mystery guest too!

As well as getting to spend the day with George Chuter – England Rugby International and Leicester Tigers legend they also witnessed Dore Metal’s Ian Hunter’s technical wizardry – as he elected to stress-test the computerized scoring system, over the course of the day.

In particular Ian highlighted weaknesses in the integrated messaging system, which resulted in localised crashes in the handheld technology on more than one occasion.

Fortunately there has not been similar issues with iMetal, at Dore Metals, which is testament to the robustness of Metalogic’s software.

The evening dinner helped massage a few egos and raise yet more money for the association’s chosen charity Sparks – with the total surpassing £23,000 for the day. Sparks fund groundbreaking medical research for childhood conditions and the days fundraising will make a huge difference in the field of paediatric research.

Metalogic welcomes leadership shown by AIIS on recent Inside US trade article

As a supplier to the global metals industry with a significant customer base in the USA Jonas Metals Division through its US operation MCMS Compusource supports the stance taken by AIIS.

Jonas Metals operates in 21 countries world wide and has seen unsuccessful attempts to restrict trading for all parties involved. The approach proposed by AIIS is both pragmatic and sensible and deserves consideration.

| World Trade Online

The president’s Section 232 investigation — and any resulting actions on steel imports in the name of national security — will not fix the underlying problem of steel excess capacity but will invite retaliation that would hurt all sectors of the U.S. economy, the American Institute for International Steel wrote in a letter to Trump this week. |

“We fully appreciate that a significant aspect of the policy rationale for this investigation is to address steel market distortions caused by large volumes of global excess capacity,” AIIS wrote, asking Trump to terminate the investigation. “We share your deep concern regarding this serious, long-standing problem, and have called for concerted, sustained, American-led diplomatic efforts to address it.”

“However,” the institute continued, “imposing job-killing trade restrictions on steel imports will do nothing to counter and roll back the prolific use of state subsidies by some countries, most especially China, that are almost completely responsible for global excess steel capacity.”

AIIS, which says it represents 120 companies supporting 1.2 million jobs in the steel-using sector, said “it would be highly premature to consider imposing any such restrictions” before the Global Forum on Steel Excess Capacity has delivered its report — as it was tasked to do by the G20 leaders at this year’s summit — or held its first ministerial meeting.

That report is due in November, when a ministerial could also be held.

Echoing sentiments made by associations representing other sectors, the group wrote that “any new trade restrictions on steel imports will result in global retaliation well outside the steel realm,” adding that “retaliation is always a ‘lose-lose’ proposition.”

The companies also urge Trump “to consider the fact that the United States steel industry is already the most protected industry sector in the country, and has been for some time.”

“Let us not attempt to further protect the few at the expense of many,” AIIS wrote

This article was first published by AIIS on 3rd October 2017

Built by JMB Creative