EU steel market: 2017 market prospects improve but risks remain

A strong start to the year and robust economic and steel market outlook bode well for EU steel market conditions. Nevertheless, increasing protectionism and even isolationism may lead to the proliferation of disastrous global trade flow distortions.

EU steel market

EU apparent steel consumption grew by 3.1% year-on-year in Q1-2017, driven by robust gains in end-user consumption. The net impact of inventory build-up was slightly negative, because the actual increase in stocks was lower than in the same period of 2016.

EU domestic suppliers, as well third country exporters, gained from the increase in EU steel demand. The improved balance in the EU steel market’s supply-side fundamentals can largely be attributed to the positive influence of anti-dumping duties in stemming dumped imports.

European Steel Association (EUROFER) Director General Axel Eggert said, “Initial data and estimates for the second quarter signal that apparent steel consumption remained on a mildly positive growth trend. However, the rather sharp rise in imports over the April-May period suggests that EU mills most likely again lost ground to third country suppliers”.

EU apparent steel consumption is forecast to continue to improve over the remainder of 2017, although seasonal destocking will have a negative effect on consumption growth in the final quarter of the year. On balance, EU apparent steel consumption is forecast to increase by 1.9% over the year 2017. In 2018, steel demand growth is expected to moderate, on a par with the mild slowdown in real consumption growth.

Mr Eggert commented, “In spite of this mildly positive demand scenario, import distortions will remain the main risk for the stability of the EU steel market. With no structural solutions for the underlying problem of global overcapacity in sight, the number of protectionist and even isolationist measures look set to increase. In particular, measures potentially stemming from the US Section 232 investigation may lead to a proliferation of disastrous global trade flow distortions.”

EU steel consuming sectors

In the first quarter of 2017, the production activity of steel-using sectors in the EU rose by a healthy 5.8% year-on-year, visibly exceeding earlier expectations of a more moderate rise in activity. To a certain degree, this growth rate was flattered by the weak activity level in Q1-2016.

While all sectors performed remarkably strongly compared with the same period in 2016, it was the steel tube sector that showed the strongest rise owing to strong pipeline project activity. However, production activity in the automotive and construction industries also rose at a significantly faster pace than anticipated.

Prospects for the remainder of 2017 and 2018 are positive, although year-on-year output growth rates are forecast to slow down as base year effects and temporary stimulation factors are expected to fade in the future.

Strengthening domestic demand fundamentals – owing to a mild acceleration in investment growth – combined with healthy export opportunities, will likely boost activity in steel-using sectors. Total output in steel-using sectors in the EU is forecast to grow by 3.5% in 2017 and by 2.1% in 2018.

EU Economic Context

The healthy performance of the EU economy in Q1-2017, and the continued positive tone of both hard and soft data, supports the view that the economic recovery is strengthening and broadening.

Domestic demand will remain buoyed up by steady private consumption growth and public expenditure. Meanwhile, the investment climate appears to be brightening, particularly as internal political uncertainty in the EU has receded since the beginning of the year. Prospects for exports are positive as well, on a par with global economic growth gaining traction in 2017 and 2018.

On balance, EUROFER’s July 2017 outlook forecasts EU GDP growth at 2% in 2017 and at 1.8% in 2018.

Press Release brought to you by Eurofer

A PDF of this Press Release is available: here

Economic and Market Report

For the full report, please click here: Economic & Steel Market Outlook – Quarter 3, 2017

Harnessing the Business Benefit of IoT while mitigating cyber risks

Content by Dimension Data brought to you by Bright Talk

The Internet of Things (IoT) is gaining mass adoption by business, government, and consumers. It’s enabling new business opportunities and re-shaping industries of all kinds as organisations seek to rapidly capitalise on digital transformation.

From financial services, healthcare, and retail to utilities, and manufacturing, IoT is set to be the next revolution because of its role in connecting businesses, machines and users. However, many IoT systems are typically unsecured, and therefore prone to cyber attacks.

Dimension Data research into attacks targeting IoT devices, published in their 2017 Global Threat Intelligence Report, indicates that IoT devices are increasingly becoming sources and targets of attack. Learn more here about the cyber security considerations for IoT, and what can IT and business leaders can do to harness its potential while mitigating risk to the organisation.

Harnessing the Business Benefit of IoT while mitigating cyber risks

The Fourth Industrial Revolution – Innovation or Inertia?

Fresh from attending Future Steel Forum 2017 in Warsaw, Poland last week, Rizwan Janjua, Head of Technology at worldsteel, talked about a key issue for our industry – ‘The Digital Revolution – The Human Factor and Inertia’.

Read more from his recent blog first published at worldsteel.

We are essentially creatures of habit and the same applies to organisations. Why modify what has always worked?

This is Inertia in a nutshell, a tendency to do nothing or to let things remain unchanged. This typically makes sense, and helps to maintain a sense of order and normality – being cautious can be sensible, as discovered during the 90’s dot com bubble. But such thinking can also lead to complacency and missed opportunities. If we choose to stand still during a period of dramatic change, we may be able hold firm for a while but eventually we may find ourselves left behind.

We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run. — Roy Amara, Institute for the Future (IFTF)

We are in the midst of the Fourth Industrial Revolution, with a myriad of powerful and affordable new software and hardware tools on offer. Buzzwords such as Industry 4.0, IoT, Smart Manufacturing and so forth that can be confusing, but if applied skilfully, they can deliver greater productivity, increased efficiency and substantive innovations that were previously out of reach.

As an industry we cannot afford to dismiss this imminent paradigm change and must embrace the array of new technologies available not simply because they are the but because they will be a key driver of competitive advantage. Whether to meet the need to continue to reduce C02 emissions or the demand for building the smart cities of the future – what is required is the adoption of a new mind-set, one that sees industry 4.0 as a facilitator in developing a continual process of improvement, rather than a one-step solution.

A company’s successful entry into this new landscape will depend upon its ability to overcome inertia and whether they have:

- A culture of product, process innovation and value creation

- A welcoming approach to new ideas and a willingness to develop them further into products and services

- A clear innovation strategy which is well understood by all staff

During our recent Technology Committee meeting (TECO), a number of steel companies noted how they have either already started integrating digitization, or hold plans to introduce significant initiatives over the next two years. Early adopters who manage this change effectively are likely to gain a clear competitive advantage from being able to deliver value-added products and services while making more efficient use of raw materials and energy.

The ongoing digital revolution presents numerous opportunities for the steel industry but we must strike while the iron is hot. What do you see as the biggest push and pull factors on our industry in embracing the digital era?

This blog was first published by worldsteel, 23rd June 2017, click the link to add your comments.

The European Commission imposes duties to counter Chinese steel subsidies

The Commission decided today to impose definitive anti-subsidy measures on imports from China of certain hot-rolled flat steel products (HRF).

It established that the Chinese government is supporting its steel industry through considerable subsidies, including preferential lending, tax rebates and other financial injections.

These subsidies have allowed the Chinese companies to sell hot rolled flat steel at artificially low prices on the EU market. This unfair competition has been creating a threat of imminent injury for the EU producers, whose profitability had sharply decreased by the end of 2015. In order to remove such threat, the Commission has today decided to impose definitive countervailing duties of up to 35.9%.

Since the adoption of the Commission’s Steel communication of 16 March 2016, the EU has put 12 anti-dumping measures in place, most of which cover products from China. The current decision looks for the first time in our current fight against steel overcapacity at Chinese government subsidies and found many different ways by which the Chinese government unfairly supports its exporters. Accordingly, the Commission decided on a significant rate of countervailing duties.

The Commission is using its available toolbox of trade defence instruments to the full extent possible. In addition, the EU is tackling the root causes of overcapacity in the global steel industry through active involvement in the Global Forum on Steel Excess Capacity launched last December.

More information is available in the EU official journal .

Steel Exports fall in April 2017

Steel exports fell by nearly one-tenth from March to April, though they remained above the April 2016 level.

The 9.6 percent monthly decline left exports at 857,582 net tons, 7.9 percent more than a year earlier.

Exports to Mexico decreased 10.3 percent to 333,923 net tons, which was 9.5 percent more than in the previous April, while exports to Canada slipped 2.8 percent to 434,364 net tons, almost 6 percent more than in the same month last year. Exports to the European Union plummeted more than 37 percent to 25,929 net tons. This, though, was still almost 39 percent more than in April 2016.

Despite the dip coming out of the first quarter, exports through the first four months of the year were up 10.3 percent compared to 2016 at 3.45 million net tons. Year-to-date exports to Mexico increased 16.2 percent to 1.38 million net tons, and exports to Canada from January to April grew by 5.5 percent to 1.68 million net tons. Exports to the European Union have spiked more than 54 percent so far this year to 116,461 net tons.

As the Department of Commerce completes its Section 232 investigation of steel imports, American officials who are considering imposing restrictions on those imports should remember that Newton’s Third Law can apply to trade, as well as physics: For every action, there is an equal and opposite reaction. Protectionist policies will almost certainly lead to retaliatory measures, which will mean significant declines in exports of steel, and most likely other goods, as well. Maintaining a free and responsible trading regime is in the long-term best interests of both importers and domestic manufacturers.

IT Crash? We’ll get you off the ground again…

In the wake of the recent chaotic disruption of British Airways IT systems and the increased risks to your online security from global cyber criminals the need to ensure reliable safe backups have never been more important.

Metalogic offer a number of cost effective solutions which includes allowing data to be backed up offsite to a secure Cloud location or providing a full remote system that can be accessed in the event of a disaster disabling your system.

Metalogic offer a number of cost effective solutions which includes allowing data to be backed up offsite to a secure Cloud location or providing a full remote system that can be accessed in the event of a disaster disabling your system.

Companies of all sizes are now implementing cloud solutions as they realise the prohibitive cost of losing their IT structure – even for only a few hours.

Options include:

- Off site back up

- Inflatable backup recovery – this means your data is compressed and kept off site and only activated if needed meaning you only pay for what you need

- Data permanently held off site that can be accessed in case of emergencies.

Any of these options offer the peace of mind of real time online business continuity service 24/7 when you can be switched to a duplicate system.

Read here how Metalogic came to the aid of one client when natural disaster struck……

World Steel in Figures 2017

The World Steel Association (worldsteel) has recently published the 2017 edition of World Steel in Figures. The publication provides a comprehensive overview of steel industry activities, stretching from crude steel production to apparent steel use, from indications of global steel trade flows to iron ore production and trade.

Edwin Basson, Director General of worldsteel, said, “This year we are celebrating our 50th anniversary. Much has changed in 50 years – back in 1967, the world produced just less than 500 million tonnes of steel. In 2016, the world produced just over 1,600 million tonnes. Most of the growth came from new industrialising nations – Brazil, China, India, Iran and Mexico.

Steel as a product is so versatile and fundamental to our lives that it is considered essential to economic growth. Consequently, for most of the past 50 years, the world has been producing increasingly more steel and sometimes more than was actually required – while at the same time, making the product universally affordable and promoting intense competition between its producers.”

Visit worldsteel for more information or download the publication World Steel in Figures 2017

Carbon costing and it’s implications for the steel industry

Following a recent workshop held by Worldsteel in Brussels earlier this month on carbon costing we are pleased to bring you their recent report for the steel industry to help understand better the diversity of future policy options in carbon costing and their possible implications. Expert speakers expressing a diversity of views on the topic had been invited.

What is carbon costing? The philosophy behind carbon costing is that applying a cost to carbon dioxide will encourage emitters to reduce their emissions by being more efficient or by changing their processes. You can apply a cost to carbon directly by, for example, introducing a carbon tax or establishing an emissions trading scheme or, indirectly by, for example, establishing fuel standards. In the steel industry where carbon dioxide emissions are related to the process, where no alternative currently exists and where possible efficiency improvements are limited, this typically introduces an additional cost of production.

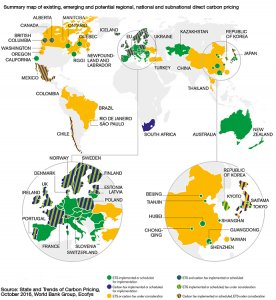

There are already many carbon costing mechanisms in place in various countries around the world today. These vary in scope, stringency and level of cost. Some have been in place for a long time already (e.g. the EU Emissions trading scheme) and some are new (e.g the emissions trading scheme in Ontario, Canada) Direct carbon costing mechanisms such as carbon taxes or emissions trading schemes often take centre stage but it was clear from the speakers at the workshop that indirect carbon costing mechanisms such as energy taxes or feed-in tariffs to support renewable energy can affect the cost of carbon emissions to a similar degree.

So, what is likely to happen in the years to come? From what we can observe there is a great interest from many countries to use carbon costing mechanisms as one of the many tools to achieve their national determined contributions under the Paris agreement. However, these are likely to be as diverse as the pledges themselves and there is a risk that inequities introduced by carbon costing mechanisms could jeopardise fair competition. This is particularly true for an internationally traded material like steel. How countries deal with this increasingly uneven playing field will be crucial; linking such diverse systems will not be easy and border adjustments could lead to serious trade implications.

The workshop touched on all these important aspects but the discussion has only started and the industry will follow closely any future development.

This blog was first published by Worldsteel.

Built by JMB Creative