AIIS Opportunity at Dept Commerce Hearing to explain how steel imports are key to National Security

Department of Commerce Section 232 Hearing24 May 2017 |

|

We are pleased to bring you the following news from The American Institute of International Steel. AIIS has secured an opportunity to explain directly to Department of Commerce officials how steel imports are a key component of U.S. national security. Out of more than 400 applicants, AIIS was one of a limited number that the agency chose to deliver a presentation during a May 24 hearing on its Section 232 investigation. Internationally recognized trade attorney Gary Horlick will speak on behalf of the Institute. As was emphasized during our recent Steel-Con 2017 conference, appearing at this hearing is just one of a series of strategically planned actions and events that we are undertaking to educate regulators and lawmakers about the positive impact that imported steel has on national security. Just as importantly, we will also be stressing the negative consequences that measures restricting the free and responsible trade in steel would have on the vast steel supply chain, the competitiveness of the nation’s manufacturing sector, and hundreds of thousands of related jobs. In addition, AIIS has a newspaper op-ed pending publication, and we are planning a possible session at the National Press Club in Washington, D.C., soon after the Commerce Department hearing. We are also seeking underwriters for an Impact Study update that will serve as the foundation for our message to both Congress and the Administration. As always, we thank you for your support of AIIS. We are proud to work with you and represent you, especially now, during what has become the most critical period for our industry in recent memory. We will keep you updated on our activities and progress, and we look forward to hearing your feedback and suggestions.

|

The Challenges of Climate Change – European Steel Day May 2017

The European Steel Association (EUROFER) hosted the European Steel Day 2017 in Brussels this month. This seventh edition of this annual event explored the theme of the ‘digital, low-carbon future for steel’.

Speaking ahead of last week’s European Steel Day 2017, EUROFER director general Axel Eggert said, “These are exciting and challenging times for the European steel industry. From trade, through to climate and innovation policy, the industry sees a range of threats and opportunities.”

“In 2016, total activity in steel-using sectors rose by 1.7% – but at the same time, imports rose to 24% of the total, up from a 17% historical share. A large part of this ballooning import share has to do with the dumping of unfairly cheap steel from third countries”, stated Mr Eggert.

According to Eggert, European steel producers face a range of regulatory costs not borne by their competitors. “This is why getting the post-2020 reform of the Emissions Trading System (EU ETS) right is so important: it must balance climate protection with the need to support the industry’s capacity for innovation and competitiveness,” he said.

“The steel industry also has a significant record in innovation. We produce thousands of grades and types of advanced steels, hundreds of which did not even exist a decade ago. These help mitigate CO2 emissions in other sectors, such as power generation. Research and development on the steel production side will also have the potential to reduce the CO2 emissions from steel production by very large proportions – as long as the right economic and research conditions prevail”, emphasised Mr Eggert.

At the event, speakers and panellists explored how the steel industry is reacting to the challenges wrought by the need to meet climate policy objectives, as well as the opportunities that are being brought about by digitisation and industry 4.0.

Is it time to get your head in the Cloud?

The onset of Cloud computing and offsite IT services means that there is less and less need for businesses to continue investing in IT systems. But how do you know when it’s time for your company to make the move? Here are five things to look out for.

1. It’s time to upgrade

Technology is constantly evolving and improving, so the demise of your company file server is guaranteed. Similarly software evolves requiring regular upgrades to get the very best functionality. If the time has come to upgrade, you should also investigate the potential for outsourcing instead. You will then:

- Convert capital expenditure to operational expenditure;

- Reduce hardware management and IT installation costs;

- Get the best solutions and services as soon as they become available; and

- Be able to focus on your business, not your IT installations.

“More than half of the IT leaders surveyed said their agencies don’t have the ability to acquire new IT resources in a timely manner, and that IT workers are often consumed with routine tasks that could be automated, such as virus scanning and troubleshooting.” – Innovation Inspiration: Can Software Save IT – MeriTalk

2. Maintenance costs continue to rise

Fact – legacy systems cost more to run than their newer counterparts. You will find that hardware management and maintenance costs continue to spiral upwards the longer they are left in place.

Instead of continuing to budget more each year, look at how outsourcing can help you budget less without compromising on functionality.

“It has been reported that 60-80 per cent of IT budgets, on average, are spent on maintaining legacy applications and the mainframe systems they run on. Previous research had put the figure between 50 and 70 per cent, suggesting that the expense of maintaining these systems is growing as they continue to age.” – What Are Your Legacy Systems Really Costing You? – Karie Barrett, Creative Director at QAT Global.

3. You’ve made a new commitment to responsible business practices

Onsite IT installations draw large amounts of energy, adding to your company’s carbon footprint. Not only do file servers draw a lot more power than desktop PCs, they also require air conditioning to prevent overheating.

Far more energy-efficient and eco-friendly is the use of outsourced IT systems, located in shared data centres. Using outsourced hardware management services and offsite IT, your business can do its bit to reduce energy use and carbon production for the good of the global community and help you uphold your responsible business commitments.

“Businesses that run applications in the cloud can reduce energy consumption and carbon emissions by about 30 per cent or more compared to running those same applications on their own on-premise infrastructure. […] And when it comes to small businesses moving to the cloud, the research revealed that net energy and carbon savings can sometimes hit more than 90 per cent.” – Microsoft.

4. Discussions about your server make the finance director cry

If discussions about onsite IT installations and hardware management costs make your finance director cry, you know its time to look at outsourcing. Your FD will love outsourced services because:

- Fiscal planning is much easier when running IT costs that are fixed by contract up-front;

- Employment and IT training costs will fall; and

- Your business can access skilled technicians without having to employ them.

Ultimately you will save money and make the FD’s job a lot easier with outsourcing.

5. You need added flexibility

Relying on onsite IT installations usually means taking control of all hardware management and planning duties too. It also involves:

- Buying new hardware to meet increasing demands;

- Trying to offload unused systems when needs change; and

- Securing staff and skills to manage both.

By moving to an offsite solution, you pay a service provider to expand or contract your IT systems as you require – all covered by the terms of your support agreement.

“77 per cent of IT leaders questioned claimed their organisations needed a more flexible IT framework” – Innovation Inspiration: Can Software Save IT – MeriTalk

Potential game changers for the future of steelmaking

Dr Bari Çiftçi’s recent speech at the 5th International Steel Industry & Sector Relations Conference in Istanbul, on the outlook on the global steel industry also focused on the growing global ferrous scrap availability and the innovative steel-making technologies which are potential game changers for the future of steel-making.

In 2016 the steel industry used about 1.2 billion tonnes of blast furnace iron (hot metal), 520 million tonnes (Mt) of ferrous scrap and 75 Mt of direct reduced iron – to produce about 1.6 billion tonnes of crude steel globally.

Global ferrous scrap demand has stagnated in the last couple of years, and the share of ferrous scrap in the total metallics demand for steel-making has declined. This is reflected in a reduced share of electric arc furnaces in the total global crude steel production, which today stands at around 25%. Electric arc furnaces use mainly ferrous scrap to produce steel.

Our estimates suggest that global scrap availability – the amount of ferrous scrap that can be collected and melted – stood at about 700 Mt in 2016. Global scrap availability is expected to reach about 1 billion tonne by 2030, suggesting that steel industry will be increasing its use of ferrous scrap considerably in the medium and long-term. The use of ferrous scrap in the steelmaking process is beneficial to the environment as it preserves the natural resources that would be used instead, reduces emissions and supports the circular economy.

The steel industry has already improved its environmental footprint considerably in the past 50 years. For example, worldsteel data show that from 1960 to 2015 global steel industry decreased its energy intensity, that is energy consumption per tonne of crude steel produced, by around 60%.

Nevertheless, as an energy intensive industry, which accounts for about 7.0% of total CO2 emissions globally, the steel industry is challenged to do more.

The industry is actively investing in innovative and breakthrough technologies that can have a dramatic impact on the steel industry’s environmental performance and its steel-making materials demand. One potential breakthrough technology is the use of hydrogen to replace carbon in metallurgical processes, thereby directly avoiding CO2 emissions. This would have a substantial impact on the demand for metallurgical coal.

There are also initiatives that focus on process integration and thus eliminating some traditional parts of the steel-making process, such as coke-making and iron ore agglomeration. The use of such technologies at an industrial scale would also result in considerable savings both in energy and CO2 emissions, and would have a significant bearing on metallurgical coal and iron ore markets.

Comments and views on the impact of growing scrap availability and the technological developments in the steel-making industry in the future can be found on the World Steel Association blog.

Short Range Outlook 2018 – The good and the not so good

The good news is that the global recovery is broadening while at the same time gaining in strength; the not so good news is the absence of a strong growth engine.

The latest world economic outlook of the IMF and OECD both point to an improving picture of the global economy for 2017 and 2018 accompanied by improving business and consumer confidence. worldsteel’s April 2017 Short Range Outlook echoes this picture: recovery in steel demand is broadening and strengthening.

Especially in 2018, all regions/countries, except China, are expected to show growth. So, the worst is over and we can expect a cyclical upturn in steel demand in the next couple of years. However, the bad news is that the growth rate will only be in the range of roughly 1% while the global GDP growth is expected to exceed 3.5%.

How can we explain the steel demand growth lagging behind the GDP growth despite the cyclical upturn? In the past, the pattern was as follows: during a cyclical upturn, steel demand growth tended to outpace GDP growth and during a cyclical downturn, steel demand deceleration outpaced GDP deceleration.

The situation we are facing now can be explained in the context of the structural changes of the global steel industry in the post crisis period.

First, since 2013, when the Chinese steel demand peaked, the growth engine has shifted from China to much smaller regions. From 2014, other emerging economies, especially the Asian emerging economies such as India and ASEAN have been the main contributors to growth, but they are much smaller in size than China (see chart below).

Secondly, investment has remained weak globally since the financial crisis. Economic recovery has been driven by consumption rather than investment, with China rebalancing toward consumption, major emerging economies suffering from structural problems, and the developed economies going through deleveraging. Steel demand is far more responsive to investment than consumption.

Thirdly, there is an important long-term force at work. Global steel intensity (the amount of steel used to produce one unit of GDP) has been declining and will continue to do so due to the long-term forces such as environmental regulations and the shift toward the circular economy which will lead to a more efficient use of materials and require lighter but stronger steel. We have already experienced a similar phenomenon in the past: following the oil crises of the mid 70’s until the year 2000, the steel intensity of GDP declined at an annual rate of 1.7%.

Most of these structural factors are not likely to change the course we are on. We can only hope that investment will become stronger on the back of improving business confidence and that the never receding uncertainties, which are today increasingly politically driven, do not kill the green shoots.

First published by Worldsteel – 21 April 2017

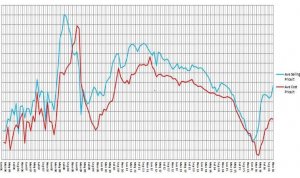

Steel Update – Credit and Risk

The Steel Market remains a challenge, the Grid up to Nov 16 shows average cost price/t against selling – that’s 4 months old now at latest point but highlights volatility. However, what the below does show is that the gap between cost and selling price is as big as its been for 10 years.

Within the Steel market, there continues to be fierce competition, over capacity, exchange rates, high energy costs and increased uncertainty due to Brexit continues to impact upon the financial strength of many businesses. The market continues to be difficult, but Underwriters are supporting to try and support trade. The standard terms tend to be 60-75 days, although we are fully aware due dates are seemingly fictional and we understand the nature of the sector and support with a healthy extension period.

Within the Steel market, there continues to be fierce competition, over capacity, exchange rates, high energy costs and increased uncertainty due to Brexit continues to impact upon the financial strength of many businesses. The market continues to be difficult, but Underwriters are supporting to try and support trade. The standard terms tend to be 60-75 days, although we are fully aware due dates are seemingly fictional and we understand the nature of the sector and support with a healthy extension period.

British steel producers have suffered from the increased levels of steel shipments originating from Russia and China, while steel prices remain depressed, largely as a result of low commodity prices and in particular iron ore. As always the intrinsically linked construction sector has a direct effect on steel, being its main consumer and insolvencies for the past year, although have shown a slight reduction, it is very slight with just over 2,500 companies entering a form of administration.

The Underwriting market have met with Tata / British Steel and they continue to provide Underwriters with up to date information. This has allowed for cover to be underwritten by some Underwriters, not all. In addition you will also note that Arcelor are back in the black in a rather big way in their last financial announcement. This has also allowed for larger limits to be written. Another risk where Management Information has been supplied is Liberty Steel and we now have appetite for this risk. However, one thing to note on all these risk they would be under a Special Risk Monitor and the amount being Underwritten would certainly be case dependant.

In short, the underwriting market is open for business, albeit watchful of their capacity but we are supporting clients and welcome meetings to discuss Credit Insurance but also to support the Supply Chain by working with a ‘risk’ with the underwriters to support their credit availability.

To discuss any of the issues further please do contact Graham Green details below.

Credit & Business Finance Ltd

Friars Mill | Bath Lane | Leicester | LE3 5BE

07944 092166 | [email protected] | www.cbfb.co.uk

Summary of the Steel Sector following NEASS AGM 2017

Following the recent NEASS AGM Colin Sanders gives us this summary of the current state of the sector.

It is widely recognised that 2016 was a year of two halves with price increases (long overdue ) having a positive effect for stockholders. I think the biggest concern for members is that of Insurers matching an increased buyer requirement. At present, accounts being filed are generally around Feb-May 2016 prior to the positive impact and it was generally felt that Insurers weren’t matching expectations of either buyer or seller. You could argue the same with credit reference agencies but insurers are still a little cautious following some big pay-outs from the likes of Caparo and Drawn Metal failures. Neither were expected and resulted in substantial pay-outs particularly from the major insurers.

Insurers will claim that they support the sector but it’s essential to assist yourselves by having the most up to date financials as possible, so ensure you badger your buyer for draft and management accounts and make these available to insurers to use as a weapon to get that limit increase.

From a Graydon perspective, we are seeing very few insolvencies which is good but we are seeing an increasing number of companies entering payment plans. Cash, or a lack of is an ever increasing problem. The ever increasing threat of fraud is also a potential nightmare. Many of our clients have been hit or attempts have been made. This might be a good time to re-inform members about the NASS Credit seminar coming up in May. One presentation will be on fraud, what to look for etc by yours truly.

Generally though, insolvencies increase when companies expand, usually too quickly and without major financial support. Expansion and the time frame is uncertain, much like steel prices in the second half of 2017.

There are positives though, particularly those who supply into automotive and to a certain degree, commercial construction. The latter needs desperately, infrastructure spending by the Government on a large scale but sadly, we are still in a period of austerity and likely to be so for some time. Yellow goods manufacturers are also enjoying an upturn Bad areas ? The oil and power sector and Brexit also brings its own uncertainties.

Graydon UK run stockholder credit control meetings every quarter – further details can be found within the minutes from the NEASS AGM below:

Further updates on the state of the industry the credit issues and the underwriting market can be read here.

Friday Big Up

Metalogic have recently introduced their own team recognition initiative. The Metalogic Friday Big Up ensures that everyone’s hard work and contributions really are valued and make Metalogic the success that it is even if they are not always recognised. Staff vote each week for fellow colleagues who have gone above and beyond to ensure they keep projects moving and customers happy. With a monthly and quarterly reward and the overall most recognised team member being put forward for MVP and a trip to who knows where.

We hope this recent article helps you understand how hard the folks at Metalogic are working to stay on top of their game and to provide you with an excellent service. We have recently introduced a customer service survey (if you didn’t receive this please contact us here) and this will be followed up by a quality indicator system on all hotline to allow us to target our efforts into the right areas.

Built by JMB Creative