Brexit SME and The Metal Markets

Short term

Currency fluctuations

Following last week’s vote to leave the EU, the pound fell overnight to its lowest level since 1985. For Metal Stockholders who in the last few years have moved to importing from overseas, they are likely to see prices rise and margins eroded. We have already seen a few of suppliers who have advised they will only be invoicing existing and future contracts in the Euro. However, for businesses selling to international customers, a dip in the pound could lead to a decent uplift in demand. Longer term the shortage of supply and the exchange rate could lead to metal shortages and prices and margins rising.

Confidence

As we saw following the recession, uncertainty does nothing for confidence – and ultimately investments and consumer spending. On the upside it will be critical for the UK to maintain its local steel manufacturing capacity as this will provide some buffer against supply shortages, long lead times and the potential difficulties in setting up new trade agreements Brexit may bring. The Leave team never really answered many of the questions about the situation British business would be in if we left the European Union. Metal distribution companies up and down the country will be waiting to learn more. Now that the prime minister has announced his resignation, it is key that a comprehensive plan is put in place to deal with confidence issues.

Staff unrest

As an employer of overseas workers the metal distribution sector will need to understand what this means to their ability to recruit workers from Europe and beyond. In the short term employees from other EU countries working in Britain will likely be feeling unsure as to what their future will be. This may lead to unrest and productivity issues.

Long term

Trade deals

For Metal distributors who trade locally, there will likely not be much impact to the level of business done. Companies that are exposed internationally, by imports or sales may see issue ranging from Anti Dumping Tariff changes, contract price changes and the removal of trade liberalisation may make what was a simpler place deal with differing legal frameworks, customs laws and taxes by creating a common system more complicated. The UK, when in the EU was privy to global trade deals which will need to be renegotiated and quickly if Britain is to retain its export status around the world.

Product

Trading as an intentional block means that product design, packaging, information and ingredients need to meet general EU law. We have seen this with the implementation of strategies like the CE mark. While this can be seen as a badge of honour internationally, the generalisation across such a wide and diverse set of countries has often lead to onerous compliance processes for British firms. A reduction in compliance may be off-set by having to produce new standards or resurrecting old one and the cost of documentation, marking and packaging that may bring.

Employment

Employment rights based on EU employment laws – such as TUPE, employee benefits, hiring workers from EU countries – could be repealed, throwing into question regulation for businesses. However, removing the freedom of movement EU agreement could mean an Australian-type points system and a way of better acquiring talent from around the world.

Funding

By being part of the EU, SMEs have been able to access grants, loans and guarantees – from sources including the European Regional Development Fund. We have seen this particularly in IT where EU support has allowed our clients to invest in state of the art equipment, training and software like iMetal to improve their business. The potential loss of access to this funding may slow down planned improvements in SME metal distributors.

One real concern long term is that being in the EU also means the UK has been viewed as more creditworthy. With the news that the UK has lost its top AAA credit rating from ratings agency S&P following the Brexit vote, borrowers in Britain might end up having to pay a higher price for credit and the availability of external financing and with that credit insurance ratings that already are under pressure in the metals sector may be reduced.

JCY Speed up the Business

For over 50 years JCY have supplied the South East of England with high quality Steel Sheet, Sheared Blanks, Tube and Hollow section. A family run business, JCY have a real pride in the responsive service they offer their customers and are always looking for better ways to deliver.

From their Basildon site, with a fleet of 5 vehicles, they offer next day delivery across their product range, from standard sheet to cut-blanks, processed bars and light-section.

fleet of 5 vehicles, they offer next day delivery across their product range, from standard sheet to cut-blanks, processed bars and light-section.

In 2015 JCY’s in-house bespoke IT systems no longer supported the company’s ambitions for delivering the highest quality service. Speed and reliability issues were in danger of compromising operations and the need for a replacement was evident.

Managing Director, Matthew England, investigated a range of systems on the market and opted for Metalogic’s iMetal system – “Our main selection criterion was not cost – we felt that iMetal, being a metals specific system, would give us continuity of functionality from our bespoke system. We could see from the start that iMetal would be simple to use and simple to learn, would deliver ‘longevity’ and still support the business as it grows.”

With only 23 employees, of which 8 would be iMetal users, Richard England, JCY’s Chairman, was concerned that implementing a new system would prove seriously disruptive – “Metalogic were able to work flexibly and train the users in a way that reduced disruption to our business. Although no fixed date for the project was set at the star t, the system went live in a timely fashion – in only a couple of months – and within budget”

t, the system went live in a timely fashion – in only a couple of months – and within budget”

And has iMetal delivered on its promises?

Matthew England “The speed with which we can get orders from customer enquiry, via the sales-desk and into the works, has significantly improved our workflow and efficiency”

Richard England “Although the system is far ‘bigger’ than we really need, it is simple to use and a good fit for our business – it operates as quickly as we could want.”

I S & G Steel use e-documents to deliver time and money savings

I S & G Steel Stockholders have been serving the Construction and Engineering sector from their 3 sites in the south east of England for over 80 years.

With their extensive range of General Steel products and Engineering Supplies, supported by unequalled experience and expertise from a workforce of over 100 personnel, I S & G are able to provide a responsive and high quality service to their many customers.

A client for over 15 years, when their ageing, mechanical document folder/envelope inserter and franking machine became too expensive to maintain, I S & G looked to Metalogic to provide a solution for the delivery of invoices and statements to their 2000 customers.

In 2015 the EMS eDocument system was installed by Metalogic and now over 50% of invoices and statements are delivered in secure PDF format by email. This has reduced postage costs alone by £400 per month, as well as further savings in terms of manpower, stationary and equipment maintenance costs.

In addition to the cost and time saving, I S & G have seen a significantly improved payment performance due to the speed at which invoices are delivered and a reduction of ‘I didn’t receive your invoice’ stories.

Peter Marquez – Finance Manager – “EMS has delivered real benefits to the business in terms time and money saved, as well as cash collected, and has enhanced the professional image of I S & G to our customers”

More and more customers are accepting invoices and statements via email and as the proportion of these increases, as it inevitably will, I S & G can look forward to doubling their cost savings.

For those customers who remain unable to receive email invoices, high quality printed documents are still available, but are printed on plain paper to reduce further the costs for pre-formatted forms. And as all documents from EMS are indexed, stored and backed up electronically, the manpower required for document handling has reduced massively.

Alan Leigh – Managing Director – “In the future we will be delivering all of our documents via EMS, the advantages of being able to email Purchase Orders, Quotations, Sales Order Acknowledgements and Test Certificates via email, more quickly and at no cost, are all too evident.”

Reasons to be cheerful!

Metalogic have reasons to be cheerful having recently been acknowledged as one of the leading performers within Jonas Software UK. Jonas Software owns and operates over 50 market leading software companies around the world. Metalogic joined the

Jonas family in 2013 and it was at the first collaborative UK group meeting this week that Metalogics’ recent performances have been recognised.

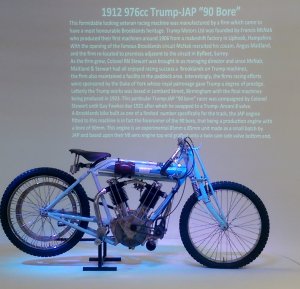

The event was designed to give further insight into Jonas and how the various individual trading entities contribute to the Jonas group. Following an early start at the National Motor Cycle Museum, Coventry, Metalogic staff were joined by their equivalents from the other businesses within the Division, along with the most senior personnel within Jonas from both the UK and Toronto

The day was engaging and informative, with an opportunity for audience participation and breakout sessions allowing staff members to work in groups to share ideas and best practices and present on their findings. Metalogic staff Sam Smith (QA) Neil Webb (CS), Geoff Ellis (R&D), Andrew Jackson (Opps) and John Padbury (PS) working with their counterparts from the other businesses made a significant contribution to the day with presentations on subjects from Automated Testing to Project Management.

Metalogic’s performance over the last year has been attributed to the adoption of iMetal as one of the leading Global ERP systems for Metals Distribution Sector, the productivity developments that working from home has delivered and the efficiency that moving the company infrastructure to the cloud has brought.

Metalogic MD Leigh Harrison, who was also a key presenter at the meeting, has been delighted with the company’s performance in often challenging market conditions. ‘I believe that whilst we have seen some good decisions made it is the commitment, skills and hard work of the team that have been the fundamental to the success of the company.’

At the end of the day attendees of the meeting had the opportunity to visit the outstanding collections that make up the National Motorcyle Museum. The museum is recognised as the finest and largest British motorcycle museum in the world, now boasting over a 1,000 machines all fully restored to the manufacturers original specifications.

However the visit had a particularly personal story for Metalogics’ Operations Manager, Andrew Jackson who’s whose great grandfather’s had made their own contribution to the world of automotive transport and in particular had gained recognition from the museum with a display of their 1902 production of the Century Tandem which the museum now displays.

New IMF and Worldsteel Forecasts

Aiis says cooperation, not litigation, key to trade

International cooperation in eliminating excess global steel capacity needs to be a top priority of the US

government, Kallanish hears from traditionally pro-trade group the American Institute for International Steel

(AIIS).

In response to a call for comments by the United States Trade Representative ahead of a hearing 12 April, AIIS

says overcapacity “… should be raised as an agenda item at the highest international levels, particularly at the

Group of 20 meeting this year in Beijing.”

“Excess steel capacity created and sustained over many years hurts a host of steel-related industries in the

United States,” AIIS says in their comments summary. “Among other things, it limits jobs and hours worked on

our docks, restrains exports, destabilises world markets, and generates mountains of needless, expensive trade

litigation that ultimately resolves very little.”

Concrete and verifiable political commitments to pare down capacity should be sought from US trading partners,

AIIS says, with an eye toward “… new binding disciplines on state-owned enterprises and related trade-distorting

subsidies.”

A soft touch may be required to build such a coalition to prevent “… the perfect [… becoming] the enemy of the

good.”

“At the same time that we engage in discussions in the OECD (Organisation for Economic Co-operation and

Development) and elsewhere, we should engage in the necessary diplomatic spadework in capitals so that we

can fully engage as many allies as possible in the overall effort to help push this process forward,” the group

says.

EUROMETAL

11.04.2016

Latest export news from AIIS

|

Falls Church, VA. April 12, 2016. Steel exports totaled 779,010 net tons in February, just 0.4 percent less than the previous month, but 11.3 percent below the level of a year earlier. Exports to both Canada and Mexico, which account for about 90 percent of all steel shipments out of the United States, both changed by less than 1 percent from January, with exports to Canada up slightly at 392,571 net tons, and exports to Mexico down a bit at 295,530 net tons. Compared to February 2015, exports to Canada dipped 3.4 percent, while exports to Mexico fell 15.8 percent. Exports to the European Union were down 5.9 percent from the previous month and 63.3 percent from the previous February at 17,824 net tons. During the first two months of the year, total exports fell 13.5 percent to 1.56 million net tons. Year-to-date exports to Canada were down 11.7 percent at 783.909 net tons, exports to Mexico fell 13.8 percent to 593,823 net tons, and exports to the European Union declined by 54.1 percent to 36,760 net tons. Exports grew by 7.8 percent from December to January, and February gave only a tiny amount of that increase back. The strong dollar has been applying downward pressure on exports, but it has lost a bit of ground recently to the Canadian dollar and the Mexican peso, though the exchange rate remains well above the level of a year ago. If “peak dollar” has come and gone, and if the economies of Canada and Mexico perform well in 2016, there could be significant growth in exports this year. But those ifs are huge. |

Eurometal outlook on economies & steel markets

EUROMETAL ECONOMIC OUTLOOK JANUARY 2016 ON ECONOMIES AND STEEL MARKETS

Built by JMB Creative